Archive for the ‘Finance’ Category

Get Your Arms In Shape . . .

. . . for Bocce ball

Friday 11 a.m. poolside.

= = = =

What . . .

. . .do vegetarians count

to go to sleep?

Heads of lettuce?

Cucumbers?

Pumpkins?

= = = =

Only Your Computer Knows Virtual Money

It’s a tenet of investing: if you don’t understand the company or product and what it does, drop it and move on to something else. Which makes the Bitcoin story bizarre. Not only is it understood by a select group of financial high flyers, no one is really sure who started it.

Since the Bitcoin’s birth a dozen years ago, it’s travelled a bumpy road the stretches from a price of $400 five years ago to more than $60,000 about a year ago. Along the way it dropped to $4,000 in 2019 from $19,000 two years earlier.

The value of Bitcoin rises only if there’s a demand for it. If no one wants it, the value drops dramatically.

If Bitcoin sounds a bit scary, there are more than 6,500 other cryptocurrencies on the market.

If Bitcoin doesn’t catch our fancy, you can purchase Ethereum, Litecoin, Stellar, Polkadot or Cardano among the thousands of other options.

None of these currencies involve printing presses. They exist only in computers – cyberspace.

There is a growing industry servicing the spending of Bitcoins after you buy them. They’re readily available at thousands of automated teller machines around the country.

And there’s a whole new language involved.

For example, Ethereum claims to be “a decentralized software platform that enables smart contracts and decentralized applications (dapps) to be built and run without any downtime, fraud, control, or interference from a third party.

“The goal behind Ethereum is to create a decentralized suite of financial products that anyone in the world can freely access, regardless of nationality, ethnicity, or faith.”

Did you get all that?

Transactions are conducted through a digital ledger called a blockchain. This involves a worldwide computer network that stores the virtual money in a digital wallet.

= = = =

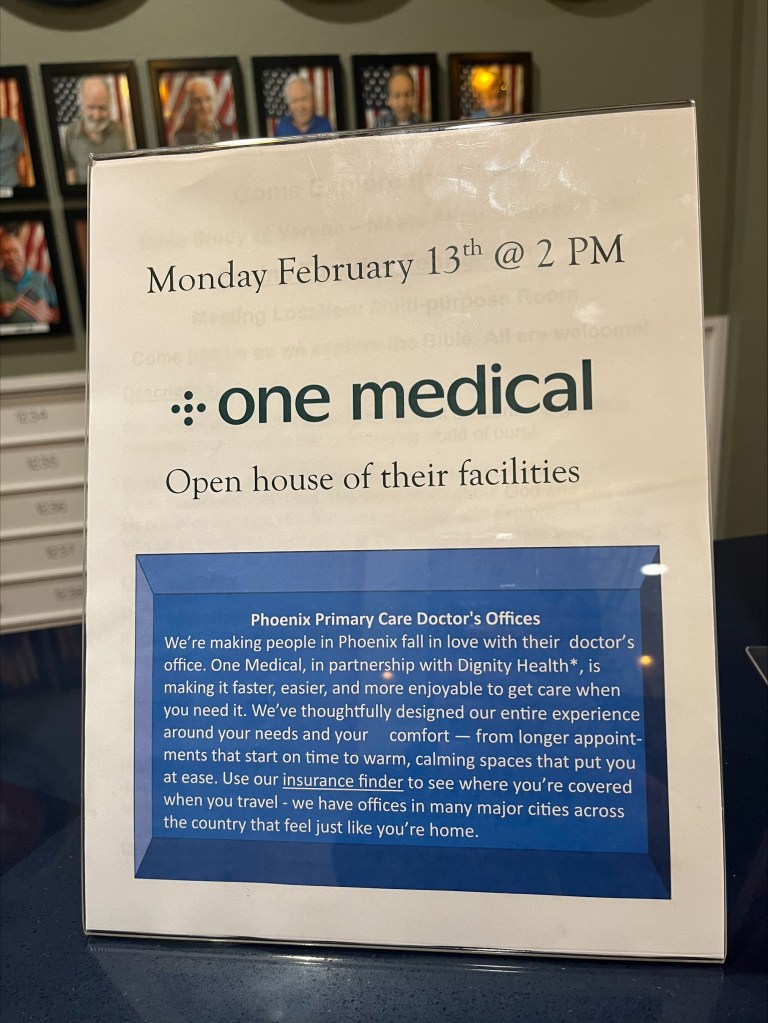

Take A Free Look At . . .

It’ll be an educational view

= = = =

Learning sign language . . .

. . . could come in handy.

= = = =

Open Sesame is Too Simple a Password

As hackers break through firewalls protecting our nation’s facilities, the rest of us are wondering how to protect our assets from internet thieves. Cyberspace crooks pounce on bank and credit card accounts to fatten their finances.

It’s vital that you make your passwords as complex as possible to shield your information. they can be sheltered in the cloud, software programs, password manager and a protection service. These usually involve a fee. Or you can store them in a simple-to-keep thumb drive.

A prime rule to call to mind is that having a password that’s easy for you to remember – an old address or your father’s birthdate – makes it easier for password-hacker hounds to sniff out and attack your data. And using the same password for everything you work at in cyberspace makes it simpler for these same hackers to scramble through all your secured sites.

What happens if you lose your thumb drive? First of all you should store your passwords on two or three such drives. Keep them in safe and secure places. One should be in a safety deposit box.

Your passwords should be complex and different for every site The doorway to your email should be different than that of your bank account that should be different than that of your medical data, which should be different than … you get the idea.

Internet security experts suggest you begin with a Shakespeare quote or a song lyric or a phrase you make up yourself.

Let’s use “Water, water everywhere and not a drop to drink.” Write down the first letter of each word. Keep the punctuation and use capital letters for stressed words and you get W,WeaNaDtD.

You might add the date you first visited the ocean (which might have caused you think of this quote). You can split it up with half in front and half at the end. If it was July 4, 1954 – 7,4,1954 — you can wind up with 741W,WeaNaDtD954.

Looks complicated doesn’t it, but you know what it means. It also meets the rule offered by password pros – use a combination of upper-case and lower-case letters, numbers and symbols. And the longer the phrase you pick, the longer the password and the more difficult it is for hackers to crack.

Password security experts also recommend padding the password to make it longer but warn against using the shift key for padding or adding symbols. They suggest adding a short string of letters — such as jkjkjk – in front of and at the end to strengthen your password against assaults by hackers.

If you make the process fun, you’re more likely to remember the formidable password you’ve developed to protect yourself out in the cyberspace.

Taxing Time

Bocce aficionados meet at 11 a.m. poolside

Talk At Our Table . . .

. . . was interrupted

when the notorious gossip nearby

increased their decibel level to proclaim,

“I don’t want to say anything bad about (deleted)

but boy is this good.”

Get Doctor’s Opinion on Medical Fees

Whether or not you have health insurance, always ask your doctor if there is a fee involved when discussing any appointment, surgery, test, procedure, or any other arrangement being made to continue your treatment.

Follow-up appointments for such purposes as checking on proper healing of minor surgery or monitoring blood pressure can be chargeable but any fee might be avoided if the patient asks the doctor about any charge when the follow-up is discussed.

For example, follow-up visits after surgery normally is included in the surgeon’s original fee. But not all, so ask to avoid surprises.

The process has been complicated by the recent rise in telemedicine: internet contact with doctors by telephone and computer. In some cases, they’re covered by Medicare, Medicaid or supplemental insurance. In some cases, they are not, so you have to check with the doctor.

Today’s The Last Day . . .

. . . to sign up for a

free 15-minute chair massage

provided by LifeQuest starting at —

10 a.m. tomorrow (Tuesday) in the 2nd floor theater.

It Takes Effort to Collect on Insurance

Most of us have several types of insurance covering, among others, auto-accident damage and liability, mortgage, renters, long-term care, home damage and liability, and death (called life insurance for some strange reason). And when we take a trip, many of us pick up a travel-insurance coverage.

But there’s work to be done to collect any benefits after the trauma of a crippling auto accident or fire that destroyed your home. And it has to be done quickly, usually while you’re still emotionally addled and physically drained by the happenstance.

Your first step is to find the policies that apply to your loss with all the pertinent information about where to file your claim. In some cases, you can call to the agent who sold you the policy to get some advice. That means you should keep our insurance policies handy. Someone else in the family or your attorney should also know where they are because you might be hospitalized and someone will have to launch your claim for you.

Make sure all instructions are followed to the letter. Unanswered questions or an overlooked step will delay the process and require redundant correspondence and contact with the insurance company.

Keep every police and medical report and all other bits of information connected to the incident prompting the claim. And every receipt. If you’re in doubt about whether a document is relevant, keep it and let the company toss it out.

If our claim involves lost or damaged property, it helps if you have a prepared inventory – photographs are better – of all your property along with a list of what’s been missing or destroyed.

File all correspondence and conversations with the insurers and don’t take no for an answer. Their job is to avoid paying out for non-qualifying and fraudulent claims. Your job is to prove to them that your claim qualifies.

Be persistent. If you hit a wall in your initial stages, ask to speak to your contact’s supervisor and present your case. If this doesn’t work discuss the matter with your attorney.

When you file claims for long-term-care reimbursement, make copies of your receipts before sending the originals to the insurance company.

Super Bowl Sunday . . .

. . . is next Sunday,

so it’s not too late

to get in on a scoreboard lottery.

Crooks Crouch in Cyberspace

The COVID-19 shutdowns, changing regulations and general pandemonium have made it easier for cyberspace vultures to plunder your lifetime savings.

High on the list of scams is a caller pretending to be from a bank or credit-card company seeking to straighten out some issue or threaten you with penalties for a reported late payment. Be wary of similar snail-mail correspondence.

Don’t call the numbers left by the caller or letter writer. Use the contact numbers you have on your bank or credit card statements if you feel you need to follow through on the matter.

Other crooked calls claim you’re late with tax payments, you’ve won a major prize, or face legal prosecution for some fictitious matter.

There’s also the caller checking on a reported attack on your credit line and asks to verify personal information ranging from address to Social Security, credit-card and bank account numbers.

Be suspicious of any unidentified emails that creep into your computer or cell phone.

If You Want People . . .

. . . to remember you,

borrow some money from them.

Don’t Choke on Pension Lump Sum

A couple we know lived through a lesson for all of us when the topic of pensions arises. The question focused on was whether they should take their pension cash with them when they retire or leave it with the company so they can receive monthly payments during their senior years.

They worked for different companies but both retired before the traditional 65-years-of-age so they could travel and enjoy life and living while they were still mobile and in relatively good health. They agreed that the wife would take her money and her husband would leave his with the firm because the total was much bigger and offered a much-more substantial monthly income.

They reached their decision after contacting a financial advisor to see what opportunities were available for investing the lump-sum pension check while still having money available for travel or medical expenses. They had set aside a sizable kitty over the years in bank certificates of deposit to cover day-to-day expenses until they could draw Social Security benefits.vEvery facet of their financial lives had been probed and programmed.

Except for one drastic occurrence.

Shortly after the husband quit working, a couple of deaths in the families that owned the controlling interest in his former company suddenly made it easy prey for a takeover. This resulted in a split in ownership/management philosophy. After a rapid series of internal battles, the company was sold. The new owners divvied it up into a handful of several divisions and sold each piece by piece.

And through all this, the original company pension was defunded and disappeared. The golden years planned by the couple were turned to trash.

This story is not to be taken as an endorsement of taking out retirement income in a lump sum. It does shine light on one of the perils of walking off the job without such an enticing check. A MetLife study revealed that one out of every five retirees who did leave the job with a lump-sum retirement payment spent it all in less than six years.

Most Drivers . . .

. . .around here

haven’t learned that

there’s more to being a motorist

than aiming a car.

If It Sounds too Good to be True . . .

A family member received an e-mail from a sender who identified themselves as an attorney in Lagos, Nigeria. They cited the list of difficulties they had tracking down any relatives of their client, who worked for the “Atlas Dreging company in Nigeria” at the time of the crash that killed him, his

wife, and two children “along sagbama express road.”

After several inquiries to various embassies, the sender decided to try the Internet to locate any

relatives of the deceased family “to assist in repatriating the money and properties left behind by

my client before they get confiscated or declared unserviceable by the bank where this huge

deposit were lodged…where the deceased had a deposit valued at about U.S. $5.3 million.”

The sender pointed out quick action was required because he only has six weeks to get back to the

bank with legitimate claimants to the fortune.

“You and I can share the money as follows, 60% shall be for me, while 40% of the funds shall be

retained by you. However, Upon release of the funds to you, My own share shall be held in trust

for me pending when I come over to your country for the disbursement of the funds stated

above,” the message continued.

So how can I go wrong, the victim asks. The money is in my hands and I hold onto it until this

lawyer fellow comes over and gets his share. And 40 percent of $5.3 million isn’t bad.

“Therefore, All I require is absolute trust and your honest cooperation to enable us see this deal

through. I guarantee that this will be executed under a legitimate arrangement that will protect

you from any breach of the law. please get in touch with me immediately as I do not have much

time at my disposal.”

It’s a scam. An obvious giveaway in this case is the stilted language, misspelling, and discordant

grammar in the message.

My bank circulated a warning about a resurgence of the Nigerian Advance Fee scheme,

which has been around for decades. But people still fall for it.

This scheme involves receipt of a letter or e-mail claiming to come from someone who works for the

Nigerian Central Bank or some Nigerian government agency.

The recipient is told the senders seek a reputable foreign company or individual into whose

account they can deposit funds to facilitate a large transaction, for which the recipient will be paid

a fee, usually a percentage of the funds being moved. A variation is to require the recipient to pay a good-faith deposit or bond to participate in this transaction.

The goal by the crooks in all these cases is to make the victim believe he or she has had the good

fortune to be singled out for such a munificent amount of money.

A Long-time Colleague . . .

. . . is in regular contact with her relatives in China.

I asked how they enjoyed Christmas

and she said they couldn’t complain.

Shop for Tax Preparer

There are some simple steps to take when hiring and reaching an agreement with someone to prepare your taxes. First of all, make appointments with three or four to discuss your situation and their backgrounds.

Find out if you’re comfortable with him or her. It’s your money you’re spending and there should be comfortable and open communication between the two of you.

Check the person’s credentials, specialized courses, range of expertise and experience, and length of time in business. Find out how busy he or she is. Will they have time to devote the time needed to meet your needs? Ask him or her about any professional affiliations and ongoing education.

And, before you leave, ask how much your tax preparation will cost.